List of Documents Required For GST Registration

For Sole Proprietorship / Individual

For Partnership deed/LLP Agreement

For Private limited/Public limited/One person company

WHAT IS GSTIN?

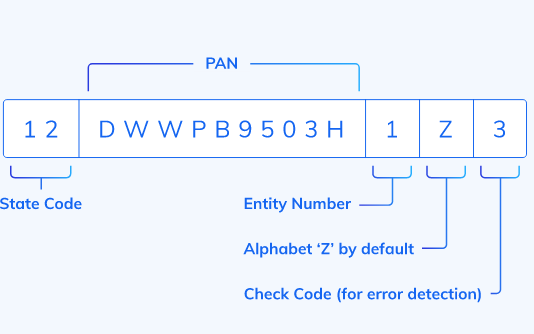

GSTIN is the short form of Goods and Services Tax Identification Number. It gets issued by the government after your GST registration has been approved. GSTIN carries 15 alphanumeric digits.

GST Registration Online - An Overview

On the date of July 1, 2017, it was announced that GST will be implemented throughout the country via One Hundred and First Amendment of the Constitution of India and it will bring revolution in the economy of the country. GST which specifies Goods and Services Tax eradicated all previous tax regime that had different taxes for different areas of the country but with the effect of GST in the country, all kinds of taxes are combined into a single system which has reduced all the intricacies that were faced in the previous system. So if you are running a business, it is essential that you apply for a GST number and get your enterprise registered for multiple added benefits. Basically, there are two classes that are considered for registration. One is a service provider and if his turnover is more than 20 lakhs than it is mandatory that he should apply for online GST registration. Similar things apply for another kind that is goods supplier, but for him, turnover is 40 lakhs or more. Even if your turnover doesn’t cross the limit you can still apply for GST registration online. If you don’t apply for GST registration even after being eligible for it, you’ll heavily be penalised for violating the rules as well as won’t be able to collect GST from customers. So, get in touch with Online GST registration today for receiving your GSTIN.

WHY I NEED GST REGISTRATION?

It is the most common question which arises in the mind of every business person. Let us tell you why it is significant to apply for online GST registration in India. Below are the factors which signify the importance of registering for GST online-

Legal Recognition:

After your enterprise has successfully registered for GST, you will be recognized as one of the government’s authorized business modules and obtain the tag of secure and trustworthy corporate. This certification will provide you with a promising platform where you can nationalize sales of your good and earn more benefits that non-registered users won’t get.

Accurate Evaluation of Taxes

Now by application of GST, you will be able to account all tax schemes properly. There will be an ease in the estimation of taxes in essence with goods and services once you are through the process of GST registration online. We make sure that GST registration fees you pay is reasonable and you get all the perquisites of it instantly.

Eligibility

As mentioned earlier if your turnover is equal or more than specified limits, it is just for you that you immediately contact online GST registration Services today and get the job done.

Collect Taxes:

Once registered you’ll have full authority to collect taxes from the purchasers and get the credit of taxes from the goods that customer has purchased. Experience this benefit with no delays. Initiate contact with us right away.

Accurate Evaluation of Taxes

Now by application of GST, you will be able to account all tax schemes properly. There will be an ease in the estimation of taxes in essence with goods and services once you are through the process of GST registration online. We make sure that GST registration fees you pay is reasonable and you get all the perquisites of it instantly.

Eligibility

As mentioned earlier if your turnover is equal or more than specified limits, it is just for you that you immediately contact online GST registration Services today and get the job done.

BENEFIT OF GST REGISTRATION

Least Compliance

Once you receive your GST registration you do not need to keep records of long records for your transactions. It comprises of the quarterly cycle so it led to the least compliance of records.

Finite Liability

This is the most basic factor which relates directly with Online Goods and Services Tax registration that it bounds the scope of your tax liability. Fill your GST registration form today.

Less Hectic

GST online registration tends to be less hectic for the taxpayer. As it involves all kinds of tax in just one tax. Moreover, it is time-saving and effortless

Extended liquidity

GST online registration takes into account the extended liquidity for the taxpayer. This is why It’s suggested to apply for GST number online India.

Greater working capital

GST registration grants you the ability to generate greater working capital in minimal spent of time. If you want to superlative working capital then get it done now.

Competitive freedom

Online GST registration provides you with the ability to compete freely in the business environment. The main reason behind this merit is that it composes the verified identity of the business.

WHAT IS GST COMPOSITION SCHEME?

GST composition scheme has been designed to eradicate the tax burden of small taxpayers. Under this scheme, it is not compiled to the small taxpayer to maintain a record of GST returns. It is required for small taxpayers to pay GST at a predetermined rate of turnover. According to this scheme any business which holds an annual turnover of Rs. 1.5 Crores can apply for GST registration.

What are the types of GST?

According to the government of India GST are of four types. The GST types are namely Integrated Goods and Services Tax (IGST), State Goods and Services Tax (SGST), Central Goods and Services Tax (CGST), and Union Territory Goods and Services Tax (UTGST). They have different taxation rates (GST rates) under them.

step

CGST: CGST (Central GST) is implemented on the supply of goods and services. This tax is levied on the interstate supplies and is governed by the central government. The central government will hold on to revenue collected under CGST.

step

2. SGST: SGST is a tax applied on Intra State supplies of both the goods and services by the State Government and will be administered by the SGST Act. The revenue is collected by the state government. However, the mainstream work of the state government is governed by the central government only.

step

3. IGST: IGST is charged on the supplies of goods and services from one state to another. Therefore, it is stated as the interstate tax. This tax is also applicable to the supplies of goods and services in both the case of import into India and export from India. The revenue is collected by the government of India.

step

04

4. UTGST: Delhi (India’s Capital Territory), Chandigarh, Dadra & Nagar Haveli, Andaman & Nicobar Islands, Daman & Diu, Lakshadweep, and Puducherry are the prominent union territories in India. UTGST applies to all these union territories. The revenue is collected by the union territory government. UTGST is levied with the CGST only.

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et nam dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco nam laboris nisi ut aliquip ex ea commodo consequat.

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et nam dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco nam laboris nisi ut aliquip ex ea commodo consequat.

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et nam dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco nam laboris nisi ut aliquip ex ea commodo consequat.

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et nam dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco nam laboris nisi ut aliquip ex ea commodo consequat.

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et nam dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco nam laboris nisi ut aliquip ex ea commodo consequat.

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et nam dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco nam laboris nisi ut aliquip ex ea commodo consequat.

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et nam dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco nam laboris nisi ut aliquip ex ea commodo consequat.

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et nam dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco nam laboris nisi ut aliquip ex ea commodo consequat.

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et nam dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco nam laboris nisi ut aliquip ex ea commodo consequat.

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et nam dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco nam laboris nisi ut aliquip ex ea commodo consequat.

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et nam dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco nam laboris nisi ut aliquip ex ea commodo consequat.

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et nam dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco nam laboris nisi ut aliquip ex ea commodo consequat.

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et nam dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco nam laboris nisi ut aliquip ex ea commodo consequat.

Contact us

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore.